ITR Filing FY 2023-24: Understanding the Deadline and Why an Extension Might Be Expected

ITR Filing FY 2023-24: Filing your income tax return (ITR) is a vital annual task that ensures you remain compliant with tax regulations while keeping your financial records in order. With the deadline for the financial year (FY) 2023-24 rapidly approaching, taxpayers are buzzing with anticipation about a possible extension. Let’s explore why an extension might be on the horizon, the challenges taxpayers face, and how to ensure you file your ITR on time.

The Importance of Timely ITR Filing

Filing your ITR is not just a legal requirement; it’s crucial for maintaining your financial health. Timely filing helps avoid penalties, ensures smooth financial transactions, and aids in quicker loan approvals. But why are many taxpayers expecting an extension this year?

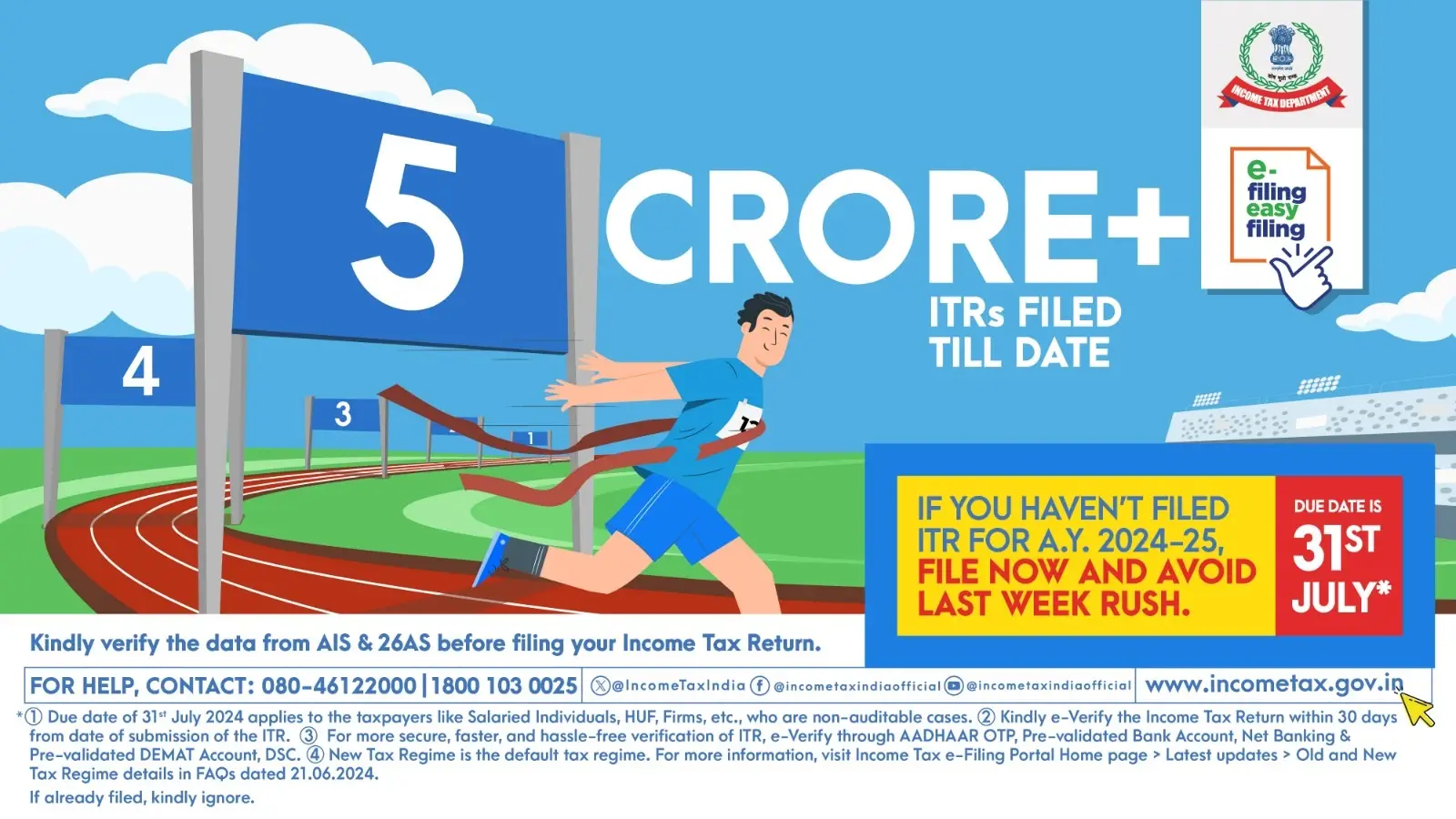

The Current Deadline: July 31, 2024

The deadline for filing your income tax return for FY 2023-24 is set for July 31, 2024. This date is critical as it marks the final day to submit your returns without incurring penalties or late fees. The income tax department has urged taxpayers to complete their filings by this date to avoid complications.

Calls for an Extension

Advocacy by Tax Practitioners

The All-India Federation of Tax Practitioners (AIFTP) has formally requested the Central Board of Direct Taxes (CBDT) to extend the deadline to August 31. They cite various challenges that taxpayers and professionals are currently facing, making it difficult to meet the existing deadline.

Technical Glitches and Access Issues

Tax practitioners have highlighted several technical glitches on the e-filing portal, complicating the filing process. Issues such as difficulties in accessing Form 26AS/AIS/TIS and OTP verification failures have been common, leading to repeated submission attempts.

Government Stance on the Deadline

Statements from Authorities

Despite technical issues, the government has maintained a firm stance on the deadline. Finance Minister Nirmala Sitharaman has emphasized the importance of timely filing. Improvements have been made to the e-filing portal to support up to 500,000 concurrent users.

Historical Precedents

Looking at historical data, the government has rarely extended the deadline in recent years, except under exceptional circumstances like the COVID-19 pandemic. This history suggests that while an extension cannot be completely ruled out, it remains unlikely under normal conditions.

Filing Statistics and Urgency

Over 5 Crore ITRs Filed by July 26

As of July 26, over 5 crore ITRs had already been filed, indicating a significant number of taxpayers are on track. The Income Tax Department has urged taxpayers to file their returns accurately to ensure timely refunds and avoid complications.

Ensuring Accurate Filing

Filing your returns accurately is essential to avoid delays in refund processing and potential penalties. Incorrect claims, under-reported income, and exaggerated deductions are common issues that can lead to notices from the tax department.

Challenges Faced by Taxpayers

Technical Difficulties

The e-filing portal, despite improvements, has not been without its issues. Taxpayers have reported difficulties in accessing necessary forms and facing repeated OTP verification failures, leading to a frustrating filing experience.

Document Verification Delays

Verifying the required documents in time can also be challenging. From obtaining the correct Form 16 from employers to ensuring all investment proofs are in place, these verifications take time and can delay the filing process.

Tips for a Smooth Filing Process

Gather All Necessary Documents Early

Ensure you have all the required documents, such as Form 16, interest certificates, investment proofs, and other relevant paperwork, well in advance. This preparation can save you from last-minute hassles.

Use Reliable Tax Software

Consider using reliable tax filing software that can help streamline the process. These platforms often come with customer support to assist with any issues you might face.

Double-Check Your Information

Before submitting your ITR, double-check all the information you have entered. Ensure that your income, deductions, and tax credits are correctly reported to avoid discrepancies.

Consequences of Missing the Deadline

Penalties and Late Fees

Missing the ITR filing deadline can lead to significant penalties and late fees. The penalty for late filing can go up to ₹10,000, and you might also face difficulties in carrying forward your losses.

Impact on Financial Transactions

Timely filing of your ITR is often required for major financial transactions, such as applying for loans or visas. A delay can lead to complications in these processes.

Conclusion

With the deadline to file your ITR Filing FY 2023-24 just around the corner, it’s crucial to act swiftly. While the possibility of an extension remains uncertain, preparing early and filing on time can save you from penalties and ensure smooth financial operations. Gather your documents, use reliable software, and double-check your entries to make the process as seamless as possible.

Read More: Discover the Realme 13 Pro Series: A Leap in AI-Powered Mobile Technology

FAQs

1. What happens if I miss the ITR filing deadline?

If you miss the deadline, you may incur a penalty of up to ₹10,000 and face difficulties in carrying forward losses. It’s also crucial for maintaining a good financial record for transactions like loan applications.

2. Are there any exceptions to the ITR filing deadline?

Extensions are rare and usually only granted under exceptional circumstances. The government has maintained the July 31 deadline consistently in recent years.

3. What should I do if I face technical issues while filing?

If you encounter technical problems, try clearing your browser cache or using a different browser. You can also contact the customer support of the e-filing portal or use reliable tax filing software.

4. Can I revise my ITR after filing?

Yes, you can revise your ITR if you discover any errors after filing. The revised return must be filed before the end of the relevant assessment year.

5. How can I ensure my ITR is accurate?

Double-check all entries, ensure you have all necessary documents, and consider using tax filing software to minimize errors. Accurately report your income, deductions, and tax credits to avoid discrepancies.